D365 Business Central : Amount Excluding VAT in Journal Entry

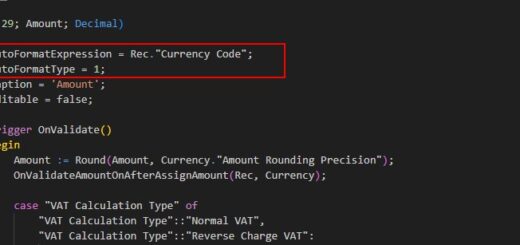

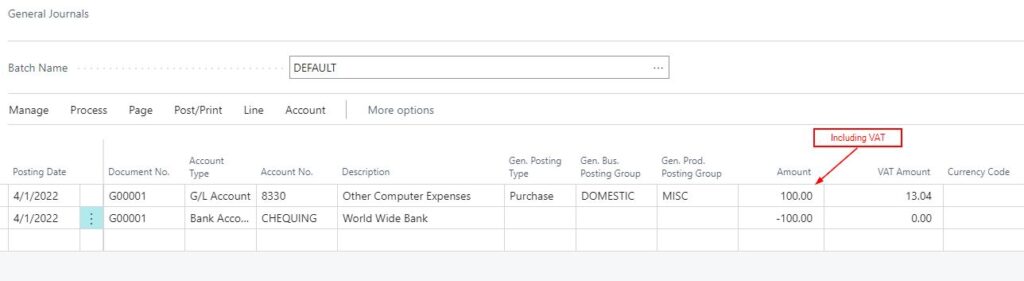

When we are entering amount on journal entry page, such as General Journal, we only have option to use Amount Including VAT. Entering the value on the Amount field will automatically calculate the VAT Amount for you.

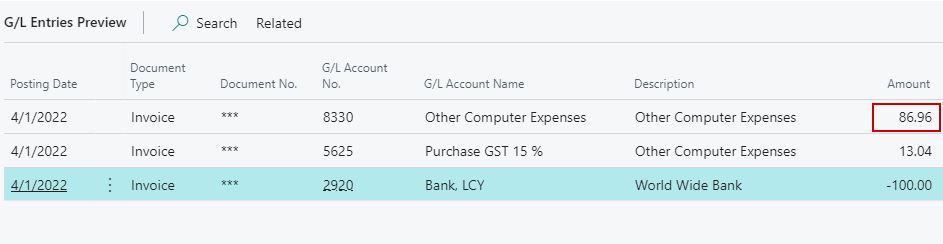

On the above example, we fill in 100 in the Amount field. Below is the result of preview posting.

Amount Including VAT is $100, VAT is 15%, Amount Excluding VAT is calculated as $86.96.

But what if you want to do it the other way around ? You want to enter Amount Excluding VAT and Business Central will calculate the VAT Amount and the Amount Including VAT for you. You can easily do this in Document, but not in Journal entry.

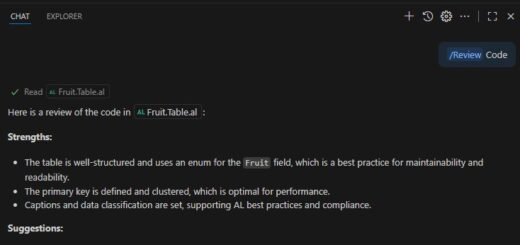

There is actually a trick to do this, but you will need to do a simple development. You need to expose VAT Base Amount field. Let’s create a page extension to do this.

pageextension 50001 "General Journal_TNG" extends "General Journal"

{

layout

{

addafter(Amount)

{

field("VAT Base Amount_TNG"; Rec."VAT Base Amount")

{

ApplicationArea = All;

ToolTip = 'Specifies the value of VAT Base Amount field.';

}

}

}

}

You can now use the VAT Base Amount field to fill in Amount Excluding VAT.

Nice and easy. Hopefully that will be helpful for you.